3.What is a Demat Account? The first step into Investment

Just like we keep our cash in a bank for safe keeping, shares are held in a account called Demat Account. It is short cut for Dematerialized account. In old days, when we become the share holders of a company we were given physical share certificates but now all the shares are held in electronic form in our Demat Account. We can create Dmat account from any depository participant. Depository participant are generally Stock brokers and Merchant Banks. Nowadays, we can simply go to any reputed bank and open a demat acoount as most of them are into merchant banking and do depository participant functions. For example if you have a bank account in Nepal Investment Bank you can go and ask to open a demat account. You will need a passport size photograph, a copy of your citizenship certificate, and around 150 rupees. I suggest you that you always carry your passport size photograph, citizenship certificate and a copy of your fathers/mothers citizenship always with you. Now a days most of the bank will offer you a free demat account when you are opening a bank account. Another way we can open a demat account is by visiting any Stock Brokers Office near you. It takes around 2 to 3 days to open a demat account. I recommend you that if you have a stock broker near you, you can open a demat account with them so that it will be easier to do trading in future.

So what's next after opening a demat account? Check out in the next blog.

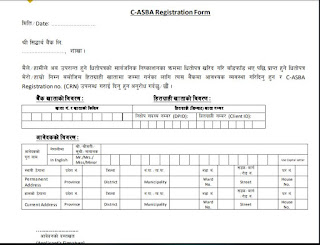

Below is a Demat Account Opening form of Global Ime Capital for your reference.

Thank You

Comments

Post a Comment